Khalifa Fund is the largest enterprise development entity in the UAE, making a significant positive impact on the SME sector through its funding and practical support.

The UAE’s entrepreneurial ecosystem is crucial for the nation’s economic growth. By partnering with Khalifa Fund, SME growth is accelerated, and commercial success is strategically achieved.

Get FundedFunding Products

Khalifa Fund has designed several funding products to support the growth and success of SMEs.

-

1. Microfinance Loan

For new entrepreneurs with project costs up to AED 1 million

Funding up to AED 500,000

Up to 80% project cost coverage

Repayment up to 60 months | Up to 18 months grace period -

2. Small Loan

For start-ups and growing micro/small enterprises

Project range: AED 1M – AED 5M

Funding up to: AED 2M (manufacturing), AED 1M (other sectors)

80% of the project cost coverage

Repayment up to 72 months | Up to18 months grace period -

3. Expansion Loan

For established SMEs ready to grow

Funding up to: AED 3M (manufacturing), AED 2M (other sectors)

80% of the project cost coverageRepayment up to 84 months | Up to 24 months grace period

-

4. Agri: Pack House & Infrastructure Development Fund (PHIDF)

Up to AED 250,000

For post-harvest facilities like storage and sanitation

90% cost coverage | Up to 36-month repayment | Up to 18-month grace period -

5. Agri: Net House Development Fund (NHDF)

Up to AED 400,000

For greenhouse modernisation and crop protection

90% cost coverage | Up to 60-month repayment | Up to 18-month grace period -

6. Agri: Water Management System Enhancement Fund (WMSEF)

Up to AED 150,000

For efficient irrigation and sustainable water technologies

90% cost coverage | Up to 48-month repayment | Up to 18-month grace period -

7. Financing Business – Operating Capital

Up to AED 600K with no minimum cash contribution

Designed to support day-to-day operational expenses and immediate cash flow needs.

Up to 12 months repayment period | Up to 3 months grace periodScale Up Funding

-

8. Financing Fixed Assets – Vehicles and Logistics

Up to 80% of the Vehicle Cost with a maximum of AED 1M

Enabling the purchase of vehicles essential for business operations and logistics including cars, trucks, boats, etc.

Minimum cash contribution: Remaining Vehicle Value

Up to 36 months repayment period | Up to 3 months grace periodScale Up Funding

-

9. Financing Fixed Assets – Machinery & Equipment

Up to 80% of the Equipment Cost with a maximum of AED 1M

For the acquisition of essential business machinery and equipment.

Minimum cash contribution: Remaining Equipment Value

Up to 36 months repayment period | Up to 3 months grace periodScale Up Funding

-

10. Bill Discounting

Up to 80% of the discounted bills with a maximum of AED 1M

To unlock immediate liquidity by financing upcoming or future receivables.

Minimum cash contribution: remaining of the discounted bills

Repayment to be made in 1 bullet payment (linked to contract) | Up to 3 months grace periodScale Up Funding

-

11. Advance Payment Guarantee (APG)

Up to 70% of the APG with a maximum of AED 1M

To support contract execution by providing advance payment security to customers.

Minimum cash contribution: Remaining of the APG

Repayment period as per contract not exceeding 36 monthsScale Up Funding

-

12. Financing E-commerce Inventory

Up to 80% of the discounted bills with a maximum of AED 1M

Enabling e-commerce SMEs to manage inventory cycles and optimize cash flow.

Minimum cash contribution: Remaining of the inventory cost

Up to 12 months repayment period | Up to 3 months grace periodScale Up Funding

-

13. Agri Tech Financing

Up to AED 2M

For agri-tech solutions driving productivity, resilience, and environmental impact

Minimum cash contribution of 10% of the loan

Between 24 to 48 months repayment period | Between 6 to 8 months grace periodScale Up Funding

Get Funded

Khalifa Fund offers medium-term, interest-free loans to Emirati entrepreneurs that will support their business potential and growth. Emirati entrepreneurs aged 21-60 with operational businesses in Abu Dhabi and Western Region can apply. Funding is available according to an eligibility criteria for businesses in Healthcare, Education, Agriculture, ICT, Tourism, Manufacturing industries and other sectors

Check your Eligibility

Designed to help entrepreneurs assess their eligibility for Khalifa Fund programs, this user-friendly interface lets you input key financial details such as funding amount, repayment period, monthly salary, net cash flow and profit for the last two years, rental income, credit card limit, and bank instalments.

Click “Calculate Eligibility” to begin your business growth journey with Khalifa Fund.

Calculations provide a provisional estimate of available funds. Actual eligibility may vary based on additional factors and final approvals. Our calculator is regularly updated for accuracy.

Assess your eligibility today!

Calculate Eligibility

Post-Funding Services

Beyond funding assistance, Khalifa Fund provides a comprehensive range of post-funding services to ensure that we support your business growth and success – every step of the way.

Disburse an Approved Loan

Initiate the disbursement process for your approved loan amount, allowing you to launch your project on time and with strategic efficiency.

Release Collateral for Funded Project Assets

Take the first step towards releasing collateral linked to your funded project assets, facilitating the growth and progression of your venture.

Amend an Existing Loan

Adjust the terms of your existing loan to better suit the evolving needs of your business – ensures financial alignment and flexibility.

Reallocation of Loan Disbursement

Maximise the impact of your funding by strategically reallocating your loan disbursement to enhance project execution and optimise resource utilisation.

Request for Loan Top-Up

Access additional funding to accelerate the growth of your project or address unexpected challenges. Continued momentum and resilience during the entrepreneurial journey is supported.

Request to Cancel Loan

Explore easy ways to cancel your loan if circumstances necessitate.

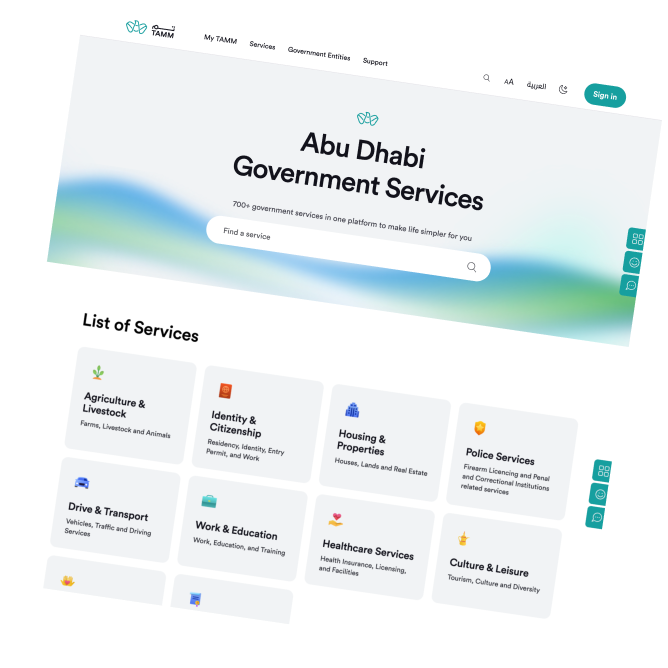

CTA to TAMM

Entrepreneurs who are looking for funding or financial support solutions, learn more and submit your application to Khalifa Fund care of the Abu Dhabi Government Services platform, TAMM.

Get FundedFrequently Asked Questions

Discover answers to common questions about applying for funding, available services, evaluation criteria, and more. If you have additional questions, feel free to contact us directly.